What Is Slice Merchant Services? Revolutionizing The Way Businesses Handle Payments

Have you ever wondered how small businesses can compete with big corporations in the digital payment space? Well, let me introduce you to Slice Merchant Services – a game-changer for businesses of all sizes. This innovative platform is transforming the way companies process payments, manage transactions, and grow their operations. If you're curious about how it works and why it matters, you're in the right place.

Picture this: a small coffee shop owner struggling to keep up with expensive payment processing fees, outdated technology, and limited customer insights. Sounds familiar? That's where Slice Merchant Services steps in. It offers a comprehensive solution designed specifically for businesses that need flexibility, affordability, and advanced features without breaking the bank.

But don't just take my word for it. In this article, we'll dive deep into what Slice Merchant Services really is, how it works, its benefits, and why it's becoming a favorite among entrepreneurs and business owners worldwide. So buckle up, because we're about to uncover everything you need to know!

Read also:Emily Compagno Children The Family Life Of A Rising Media Star

Table of Contents

- What is Slice Merchant Services?

- A Brief History of Merchant Services

- How Does Slice Merchant Services Work?

- Key Features of Slice Merchant Services

- Benefits for Businesses

- Slice vs Other Merchant Services

- Pricing Plans & Structures

- Security Measures

- Customer Support Experience

- Final Thoughts

What is Slice Merchant Services?

Alright, let's start with the basics. Slice Merchant Services is not just another payment processor; it's a powerful tool designed to help businesses thrive in today's fast-paced digital economy. At its core, it provides a seamless way for merchants to accept credit card payments, manage transactions, and access valuable insights about their customers and sales performance.

One of the coolest things about Slice Merchant Services is its scalability. Whether you're running a tiny boutique or a medium-sized enterprise, this platform grows with your business. It offers a range of features that cater to different needs, ensuring that no matter where you are in your entrepreneurial journey, you have the tools to succeed.

So, how exactly does it stack up against other merchant services providers? Stick around, and we'll break it down for you. But first, let's take a quick trip down memory lane to understand where merchant services came from and why they're so important in the modern world.

A Brief History of Merchant Services

Merchant services haven't always been as advanced as they are today. Back in the day, businesses had to rely on cash or checks for transactions, which was both inconvenient and risky. Enter credit cards – a game-changing innovation that allowed people to make purchases without carrying large amounts of cash.

However, processing credit card payments wasn't exactly straightforward. Merchants needed physical terminals, complex agreements with banks, and often faced hefty fees. Fast forward to the present, and we have platforms like Slice Merchant Services that simplify the entire process.

Nowadays, businesses can accept payments online, in-person, or even via mobile apps, all thanks to advancements in technology and the rise of fintech companies. Slice Merchant Services is at the forefront of this revolution, offering cutting-edge solutions that empower businesses to focus on what they do best – serving their customers.

Read also:Stocktwits Ibrx Your Ultimate Guide To Navigating The Social Finance Revolution

How Does Slice Merchant Services Work?

Let's get into the nitty-gritty of how Slice Merchant Services operates. Essentially, it acts as an intermediary between your business and the financial institutions involved in processing payments. Here's a step-by-step breakdown:

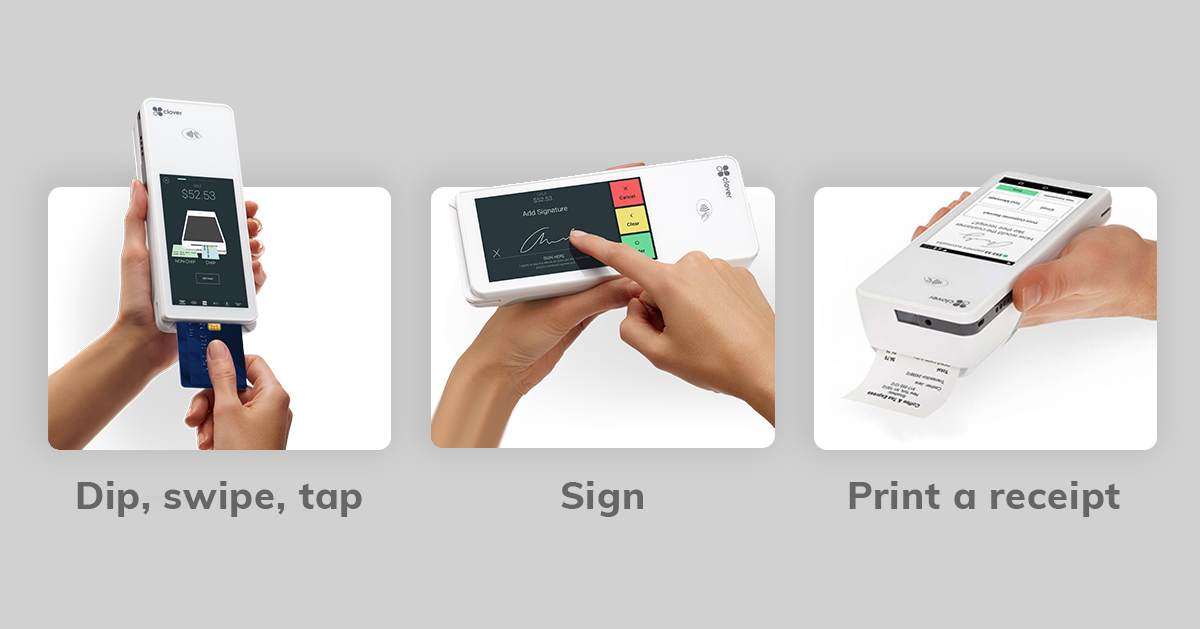

- Accept Payments: Whether it's through a point-of-sale (POS) system, an e-commerce platform, or a mobile app, Slice allows you to accept various forms of payment, including credit cards, debit cards, and digital wallets.

- Process Transactions: Once a payment is made, Slice securely processes the transaction, ensuring that funds are transferred to your account quickly and efficiently.

- Provide Insights: Beyond just processing payments, Slice offers detailed analytics and reports that help you understand your business better. From sales trends to customer behavior, you'll have access to valuable data to guide your decision-making.

And the best part? It's all done through a user-friendly interface that requires minimal technical knowledge. Even if you're not a tech wizard, you'll find it easy to navigate and manage your transactions.

Why Choose Slice Merchant Services?

When you compare Slice Merchant Services to other providers, one thing becomes clear – it's all about the experience. From the moment you sign up to the ongoing support you receive, Slice prioritizes your success. Plus, its competitive pricing and transparent fee structure make it an attractive option for businesses of all sizes.

Key Features of Slice Merchant Services

Now that we've covered the basics, let's talk about what makes Slice Merchant Services stand out. Below are some of its most impressive features:

1. Seamless Payment Integration

Whether you're using Shopify, WooCommerce, or any other e-commerce platform, Slice integrates effortlessly. This means you can start accepting payments right away without worrying about complicated setups or compatibility issues.

2. Advanced Security

Security is a top priority for Slice Merchant Services. With features like tokenization, encryption, and PCI compliance, you can rest assured that both your business and your customers' data are protected.

3. Real-Time Analytics

Want to know how your business is performing? Slice provides real-time analytics that give you insights into your sales, customer demographics, and more. This data-driven approach helps you make informed decisions and optimize your operations.

Benefits for Businesses

So, why should you consider Slice Merchant Services for your business? Here are just a few reasons:

- Affordable Fees: Say goodbye to hidden charges and exorbitant fees. Slice offers transparent pricing that won't break the bank.

- Scalability: As your business grows, Slice grows with you. Whether you're just starting out or expanding rapidly, this platform adapts to meet your needs.

- Customer Support: Need help? Slice's dedicated support team is available to assist you whenever you encounter issues or have questions.

These benefits, combined with its innovative features, make Slice Merchant Services a top choice for businesses looking to streamline their payment processes.

Slice vs Other Merchant Services

Let's face it – there are plenty of merchant services providers out there. So, how does Slice compare to the competition? Here's a quick rundown:

- Stripe: While Stripe is a popular choice, it often lacks the personalized touch that Slice offers. Plus, Slice's pricing can be more competitive for smaller businesses.

- Square: Square is great for simplicity, but it may not offer the same level of customization and analytics as Slice.

- PayPal: PayPal is well-known, but its fees can add up quickly. Slice provides a more cost-effective solution for businesses that process high volumes of transactions.

Ultimately, the choice comes down to what your business needs. If you're looking for a balanced mix of affordability, functionality, and support, Slice Merchant Services is hard to beat.

Pricing Plans & Structures

Talking about pricing, Slice Merchant Services offers a variety of plans to suit different business models. Here's a breakdown:

1. Starter Plan

Ideal for small businesses just getting started. This plan includes basic payment processing capabilities at a low, flat rate.

2. Pro Plan

Perfect for growing businesses that require more advanced features, such as detailed analytics and customizable payment options.

3. Enterprise Plan

Designed for larger businesses with complex needs, this plan offers premium support, enhanced security, and tailored solutions to meet your specific requirements.

Regardless of which plan you choose, Slice ensures that you only pay for what you use, eliminating unnecessary costs and keeping your expenses under control.

Security Measures

In today's digital age, security is paramount. Slice Merchant Services understands this and has implemented several measures to safeguard your business and your customers:

- Encryption: All transactions are encrypted to protect sensitive data during transmission.

- Tokenization: Sensitive information is replaced with tokens, making it harder for hackers to access.

- PCI Compliance: Slice adheres to the Payment Card Industry Data Security Standard (PCI DSS), ensuring that your business meets the highest security standards.

With these robust security measures in place, you can focus on running your business without worrying about potential breaches or fraud.

Customer Support Experience

Let's talk about customer support because, let's be real, it makes or breaks a service. Slice Merchant Services prides itself on offering exceptional support to its users. Whether you need help setting up your account, troubleshooting issues, or simply want advice on optimizing your payments, their team is there to assist you.

And guess what? You won't be stuck waiting for hours on hold. Slice offers multiple channels for support, including phone, email, and live chat, ensuring that you can reach them whenever you need assistance. Plus, their support team is knowledgeable and friendly, making the entire experience smooth and stress-free.

Final Thoughts

In conclusion, Slice Merchant Services is a powerful tool that every business owner should consider. From its innovative features and competitive pricing to its robust security measures and excellent customer support, it ticks all the boxes for a top-notch merchant services provider.

So, if you're ready to elevate your business and take your payment processing to the next level, why not give Slice Merchant Services a try? Who knows – it might just be the missing piece of the puzzle you've been looking for.

And hey, don't forget to share your thoughts in the comments below. What do you think about Slice Merchant Services? Have you used it before? Let's chat!