Routing Number PNC Bank: A Simple Guide To Understanding And Using It

Ever wondered what a routing number is and why it's so crucial when dealing with PNC Bank? Well, buckle up because we're diving deep into the world of routing numbers, breaking it down in a way that even your grandma could understand. Whether you're setting up a direct deposit or transferring funds, knowing your routing number is like having the secret code to unlock your financial transactions. So, let's get started and demystify this banking jargon together.

In today's fast-paced world, managing finances has never been easier—or more confusing. With digital banking taking over, understanding the ins and outs of your bank accounts is essential. One of the most important pieces of information you'll need when dealing with banks is your routing number. But what exactly is it? Why does it matter? And how do you find it for PNC Bank? We've got all the answers you're looking for.

This guide isn't just another boring article filled with banking jargon. We're here to break it down in a way that's easy to digest, practical, and (dare we say) even entertaining. By the end of this, you'll be a routing number pro, ready to tackle any banking task that comes your way. So, let's dive in and make sense of those numbers once and for all.

Read also:Geraldo Rivera Wives The Untold Story Of Love Fame And Legacy

What is a Routing Number?

Alright, let's start with the basics. A routing number is essentially a nine-digit code that identifies your bank or financial institution in the United States. Think of it as your bank's address—it helps direct your money to the right place when you're making transactions. Without a routing number, your funds might end up lost in cyberspace or, worse, in someone else's account. Yikes!

There are two main types of routing numbers you should know about: ABA routing numbers and ACH routing numbers. The ABA (American Bankers Association) routing number is typically used for paper checks, while the ACH (Automated Clearing House) routing number is used for electronic transfers. Fun fact: for most banks, including PNC, these numbers are usually the same, but it's always a good idea to double-check.

Here's the kicker—your routing number isn't just any random sequence of digits. It's carefully structured to ensure accuracy and security. The first four digits represent the Federal Reserve Bank district where your bank is located. The next four digits identify your specific bank, and the last digit acts as a checksum to verify the validity of the entire number. Pretty cool, right?

Why is a Routing Number Important?

Now that we know what a routing number is, let's talk about why it matters. Simply put, a routing number is the backbone of any financial transaction. Whether you're setting up direct deposits, paying bills online, or transferring money between accounts, your routing number ensures that your funds are sent to the correct destination.

Here's a quick rundown of some common scenarios where you'll need your routing number:

- Direct Deposits: If you're lucky enough to have a steady paycheck, setting up direct deposit is a no-brainer. Your employer will need your routing number to deposit your salary directly into your account.

- Bill Payments: Paying bills online is convenient, but you'll need your routing number to authorize those payments.

- Wire Transfers: Need to send or receive a large sum of money? Your routing number is crucial for ensuring the funds reach the right account.

- Peer-to-Peer Transfers: Platforms like Venmo and Zelle often require your routing number to link your bank account.

Without a routing number, these transactions would be impossible—or at least a whole lot more complicated. So, it's safe to say that this little nine-digit number is a pretty big deal.

Read also:Courseraqg Your Ultimate Gateway To Worldclass Online Learning

Routing Number PNC Bank: The Basics

Let's narrow our focus to PNC Bank, one of the largest financial institutions in the United States. Founded in 1852, PNC has grown into a powerhouse with over 2,400 branches and 9,000 ATMs across the country. But when it comes to routing numbers, things can get a bit tricky.

PNC Bank doesn't use just one routing number for all its branches. Instead, it assigns different numbers based on the state where your account was opened. This is because routing numbers are tied to specific geographic regions, so the number you use might differ depending on where you live. Don't worry, though—we'll show you how to find the right one for your account.

For example, if you opened your PNC account in Pennsylvania, your routing number would be 031000056. But if you opened it in Ohio, your routing number would be 041001043. See how that works? It's all about location, location, location.

How to Find Your PNC Bank Routing Number

Finding your PNC Bank routing number is easier than you might think. There are several ways to locate it, depending on your preference:

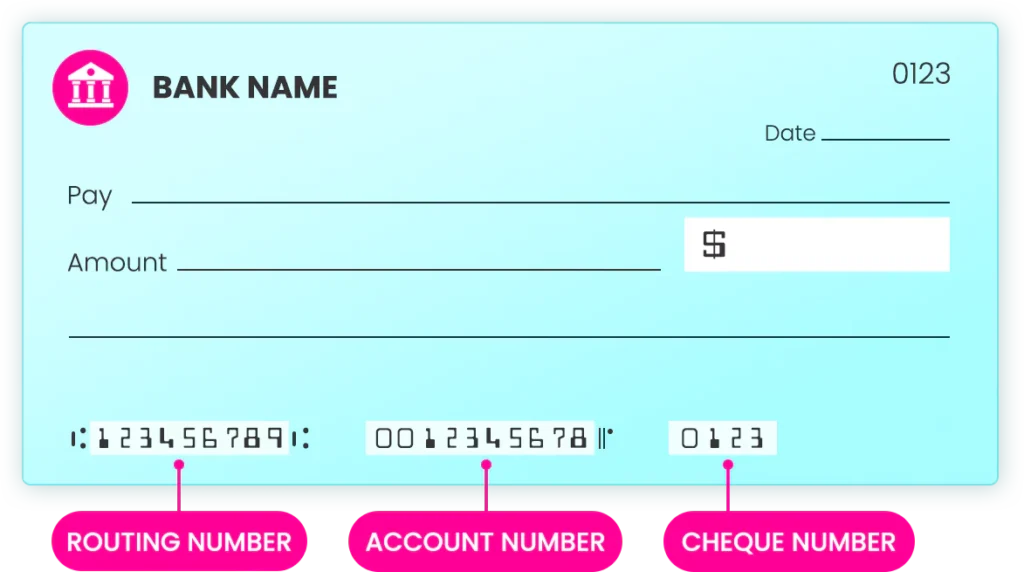

- Check Your Checks: The easiest way to find your routing number is by looking at the bottom of your personal checks. It's the first set of numbers on the left-hand side. Just make sure it's the correct number for your state.

- PNC Online Banking: If you're a digital native, you can log in to your PNC online banking account and navigate to the "Account Details" section. Your routing number should be listed there.

- PNC Mobile App: For those who prefer mobile banking, the PNC Mobile App is a great option. Simply open the app, go to your account details, and voilà—there's your routing number.

- Call PNC Customer Service: If all else fails, you can always call PNC's customer service line at 1-888-PNC-BANK. They'll be happy to help you find your routing number.

Pro tip: Always double-check the routing number before making any transactions. Mistakes happen, and using the wrong number could lead to delays or even lost funds. Better safe than sorry!

Common Mistakes to Avoid with Routing Numbers

Let's face it—mistakes happen. But when it comes to routing numbers, even the smallest error can cause big problems. Here are some common mistakes to watch out for:

Using the Wrong Routing Number: As we mentioned earlier, PNC Bank assigns different routing numbers based on location. Using the wrong number could result in your funds being sent to the wrong place—or not being sent at all.

Confusing Account Numbers with Routing Numbers: Your account number and routing number are two entirely different things. Make sure you're using the correct one when setting up transactions.

Forgetting to Double-Check: Always take a second look at the numbers you're entering. A single digit out of place can cause major headaches down the line.

By being aware of these potential pitfalls, you can save yourself a lot of time and frustration. And if you ever find yourself in a bind, don't hesitate to reach out to PNC's customer service team for assistance.

Is My Routing Number the Same as My Account Number?

This is a question we get a lot, and the answer is a resounding no. Your routing number and account number serve entirely different purposes. While your routing number identifies your bank, your account number identifies your specific account within that bank.

Think of it like your home address. Your routing number is like your city or state, while your account number is like your street address. Both are necessary to ensure that your funds are delivered to the right place.

Another important distinction is that your routing number is always nine digits, while your account number can vary in length depending on your bank and account type. So, if you're ever unsure which number to use, just remember—routing number first, account number second.

Security Tips for Protecting Your Routing Number

In today's digital age, protecting your personal information is more important than ever. While routing numbers aren't as sensitive as, say, your Social Security number, they can still be misused if they fall into the wrong hands. Here are some tips to keep your routing number safe:

- Don't Share It Unnecessarily: Only provide your routing number when absolutely necessary, such as for legitimate financial transactions.

- Use Secure Platforms: When entering your routing number online, make sure the website or app is secure and reputable. Look for the padlock icon in the URL bar and ensure the address starts with "https."

- Monitor Your Accounts: Keep an eye on your bank statements and account activity for any suspicious transactions. If you notice anything out of the ordinary, report it to PNC immediately.

- Shred Sensitive Documents: If you have old checks or bank statements lying around, make sure to shred them before disposing of them. Identity thieves can use this information to commit fraud.

By following these simple steps, you can help protect your routing number and keep your finances secure.

How Routing Numbers Have Evolved Over Time

Routing numbers have come a long way since their inception in 1911. Originally created by the American Bankers Association (ABA) to streamline check processing, they have since evolved to accommodate electronic transactions and digital banking.

With the rise of online banking and mobile apps, routing numbers have become even more important. They now play a crucial role in everything from direct deposits to international wire transfers. And as technology continues to advance, we can expect routing numbers to adapt and evolve alongside it.

But one thing remains constant—the importance of accuracy. Whether you're using a routing number for a paper check or an electronic transfer, getting it right is essential for ensuring your transactions go smoothly.

Can I Use My Routing Number for International Transfers?

Great question! While routing numbers are primarily used for domestic transactions within the United States, they can also play a role in international transfers. However, it's important to note that international transfers often require additional information, such as a SWIFT code or IBAN.

For example, if you're sending money from your PNC account to an overseas recipient, you'll need to provide both your routing number and your account number, as well as the recipient's bank details. PNC may also charge fees for international transfers, so it's a good idea to check with them beforehand.

Pro tip: If you're planning to make frequent international transfers, consider using a specialized service like Wise or Revolut. These platforms often offer better exchange rates and lower fees compared to traditional banks.

Conclusion: Mastering Your Routing Number

And there you have it—a comprehensive guide to understanding and using your PNC Bank routing number. Whether you're setting up direct deposits, paying bills online, or transferring funds, knowing your routing number is essential for navigating the world of modern banking.

Remember, accuracy is key. Always double-check your routing number before making any transactions, and don't hesitate to reach out to PNC's customer service team if you have any questions or concerns. And most importantly, stay vigilant when it comes to protecting your personal information.

So, what are you waiting for? Go ahead and share this article with your friends and family, or leave a comment below letting us know what you think. Together, we can make banking easier, safer, and a whole lot less intimidating. Happy routing!

Table of Contents

- Routing Number PNC Bank: A Simple Guide to Understanding and Using It

- What is a Routing Number?

- Why is a Routing Number Important?

- Routing Number PNC Bank: The Basics

- How to Find Your PNC Bank Routing Number

- Common Mistakes to Avoid with Routing Numbers

- Is My Routing Number the Same as My Account Number?

- Security Tips for Protecting Your Routing Number

- How Routing Numbers Have Evolved Over Time

- Can I Use My Routing Number for International Transfers?

- Conclusion: Mastering Your Routing Number