PNC Bank Georgia Routing Number: A Comprehensive Guide You Need

Looking for the PNC Bank Georgia routing number? You’ve landed at the right place. Whether you’re setting up direct deposits, paying bills online, or initiating wire transfers, understanding your bank’s routing number is crucial. In this article, we’ll break down everything you need to know about PNC Bank’s routing numbers in Georgia, ensuring you never miss a beat when managing your finances.

Let’s face it, life gets busy, and sometimes the little details can slip through the cracks. Knowing your bank’s routing number might seem like a small thing, but trust me, it’s a big deal when you need it. Whether you’re trying to get that paycheck deposited on time or sending money to a loved one, having the correct routing number ensures everything runs smoothly.

Don’t worry if you’re not sure where to start. This guide is packed with all the essential info you’ll need to navigate the world of PNC Bank’s routing numbers in Georgia. Let’s dive in!

Read also:Abby Phillips Salary The Inside Scoop On Her Career Earnings And More

What is a Routing Number Anyway?

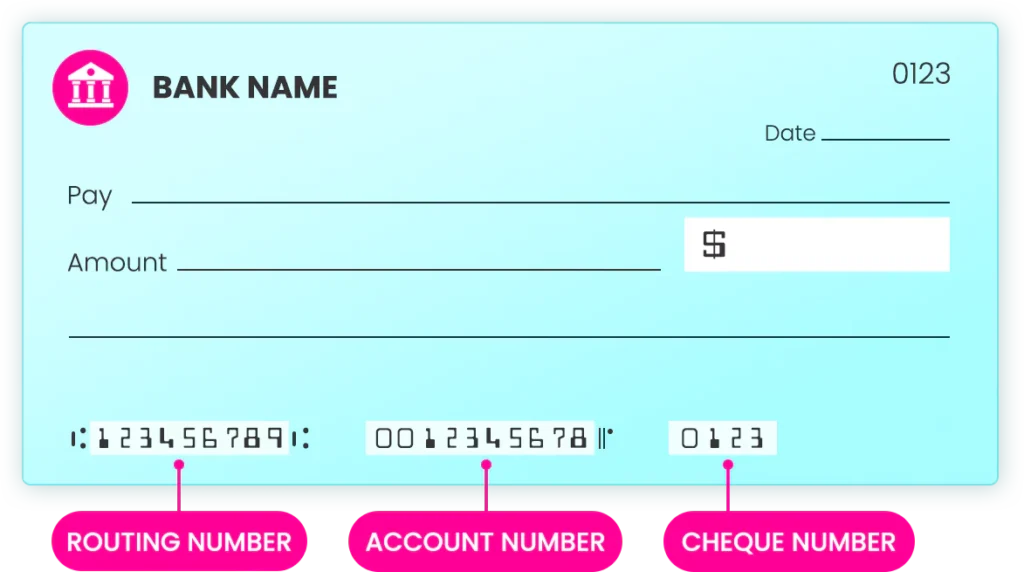

Before we jump into the specifics of PNC Bank Georgia routing numbers, let’s first tackle the basics. A routing number is essentially a bank’s address. It’s a nine-digit code that helps identify which financial institution your money belongs to. Think of it as a postal code for your bank account, making sure your funds arrive at the right destination.

Routing numbers are used for various transactions, including direct deposits, automatic bill payments, and wire transfers. Each bank has its own unique routing number, and sometimes, depending on the region, there can be multiple routing numbers for the same bank.

PNC Bank Georgia Routing Number: The Lowdown

So, what’s the deal with PNC Bank Georgia routing numbers? Well, for customers in Georgia, the routing number you’ll typically use is 061000096. This number is specific to PNC Bank’s operations in the state and ensures all your transactions are processed correctly.

It’s worth noting that while this is the primary routing number for Georgia, PNC Bank may have different numbers for other services like wire transfers. Always double-check with your bank to make sure you’re using the right one for your specific needs.

Why Does the Routing Number Matter?

Routing numbers might seem like just a bunch of random digits, but they play a vital role in ensuring your financial transactions go off without a hitch. Without the correct routing number, your payments could get delayed or even lost in the system. That’s why it’s so important to have the right one on hand.

For example, if you’re setting up direct deposit for your paycheck, your employer will need both your account number and the correct routing number to ensure your money lands in your account on time. The same goes for paying bills online or transferring money between accounts.

Read also:Whats An Otter In The Gay World A Comprehensive Guide To Understanding Otters And Their Role In Lgbtq Culture

How to Find Your PNC Bank Routing Number

Now that you know why routing numbers are important, let’s talk about how to find yours. There are several ways to locate your PNC Bank Georgia routing number:

- Check Your Checks: The routing number is usually printed on the bottom left corner of your personal checks.

- Online Banking: Log in to your PNC Bank account online and navigate to the account details section. Your routing number should be listed there.

- Mobile App: Download the PNC Bank app and access your account information. The routing number is typically available in the account summary section.

- Call Customer Service: If all else fails, give PNC Bank a call. Their customer service team can provide you with the correct routing number for your account.

Remember, different types of transactions may require different routing numbers, so always confirm which one you need before proceeding.

Understanding Wire Transfers and Routing Numbers

When it comes to wire transfers, things can get a little tricky. Unlike regular ACH transfers, wire transfers often require a separate routing number. For PNC Bank customers in Georgia, the wire transfer routing number is typically 043000096.

Wire transfers are usually faster and more secure than ACH transfers, but they also come with higher fees. Make sure you have the correct wire transfer routing number before initiating a transaction to avoid any complications.

Key Differences Between ACH and Wire Transfers

Here’s a quick breakdown of the main differences between ACH and wire transfers:

- ACH Transfers: These are typically used for recurring payments, like direct deposits or bill payments. They’re slower but more cost-effective.

- Wire Transfers: These are ideal for one-time, large transactions where speed and security are top priorities. They’re faster but come with higher fees.

Knowing which type of transfer you need will help you choose the right routing number for your transaction.

Common Mistakes to Avoid

Mistakes happen, but when it comes to routing numbers, even a small error can cause big problems. Here are a few common mistakes to watch out for:

- Using the Wrong Routing Number: Always double-check that you’re using the correct routing number for your specific transaction.

- Transposing Digits: A simple typo can lead to delays or failed transactions. Take your time when entering your routing number.

- Not Verifying with the Bank: If you’re unsure about which routing number to use, don’t guess. Contact PNC Bank directly to confirm.

By avoiding these common pitfalls, you can ensure your transactions go smoothly every time.

Tips for Managing Your PNC Bank Account

Now that you’ve got your routing number sorted, here are a few tips to help you manage your PNC Bank account more effectively:

- Set Up Alerts: Use PNC Bank’s mobile app to set up alerts for account activity, balance updates, and upcoming payments.

- Monitor Your Transactions: Regularly review your account statements to catch any unauthorized transactions early.

- Explore Online Tools: Take advantage of PNC Bank’s online tools, like budgeting apps and savings calculators, to help you manage your finances more efficiently.

With these tips in mind, you’ll be well on your way to mastering your PNC Bank account.

Staying Secure: Protecting Your Routing Number

While routing numbers are public information, it’s still important to keep them safe. Avoid sharing your routing number unnecessarily and always verify the recipient before initiating any transactions.

PNC Bank also offers several security features, like two-factor authentication and fraud protection, to help keep your account secure. Take advantage of these tools to safeguard your financial information.

PNC Bank’s Commitment to Customer Service

PNC Bank prides itself on providing top-notch customer service. Whether you need help finding your routing number or resolving a transaction issue, their team is here to assist you every step of the way.

With over 2,600 branches and 9,000 ATMs across the country, PNC Bank offers convenient access to banking services wherever you are. Plus, their online and mobile banking platforms make managing your finances easier than ever.

Why Choose PNC Bank?

Here are a few reasons why PNC Bank stands out from the competition:

- Comprehensive Banking Solutions: From checking and savings accounts to loans and investments, PNC Bank has everything you need to manage your finances.

- Strong Community Focus: PNC Bank is committed to giving back to the communities it serves, offering programs and initiatives to support local businesses and nonprofits.

- Reliable Customer Support: With 24/7 customer service and a wide range of resources available online, PNC Bank ensures you always have the support you need.

When it comes to banking, PNC Bank is a trusted partner you can rely on.

Conclusion: Take Control of Your Finances

Understanding your PNC Bank Georgia routing number is just the first step in taking control of your finances. By knowing how to find and use your routing number correctly, you can ensure all your transactions are processed smoothly and efficiently.

Remember to always double-check the routing number you’re using and don’t hesitate to reach out to PNC Bank’s customer service team if you have any questions or concerns. With the right tools and knowledge, managing your finances has never been easier.

So, what are you waiting for? Take action today by setting up those direct deposits, paying your bills online, or initiating that wire transfer. Your financial future is in your hands, and with PNC Bank, you’ve got a trusted partner to help you every step of the way.

Table of Contents

- What is a Routing Number Anyway?

- PNC Bank Georgia Routing Number: The Lowdown

- Why Does the Routing Number Matter?

- How to Find Your PNC Bank Routing Number

- Understanding Wire Transfers and Routing Numbers

- Common Mistakes to Avoid

- Tips for Managing Your PNC Bank Account

- Staying Secure: Protecting Your Routing Number

- PNC Bank’s Commitment to Customer Service

- Why Choose PNC Bank?

And there you have it, folks! Everything you need to know about PNC Bank Georgia routing numbers and more. Now go out there and take charge of your financial journey!