What Is PNC Bank Routing Number? A Simple Guide To Understanding And Using It

Ever wondered what the heck a PNC Bank routing number is and why it’s so important? You’re not alone. This tiny yet crucial string of digits plays a massive role in how your money moves from one account to another. Whether you’re setting up direct deposits, paying bills online, or transferring funds, knowing your routing number is like having the secret code to your financial transactions. Let’s break it down step by step so you’re never left scratching your head again.

In today’s fast-paced world, managing finances has become easier than ever, thanks to digital banking. But with all the jargon floating around, it’s easy to get confused. One term that often pops up is “routing number.” For PNC Bank customers, understanding what this number means and how to use it can save you a ton of hassle. We’ll cover everything you need to know in this guide.

Don’t worry if you’ve never paid much attention to routing numbers before. By the end of this article, you’ll be a pro at identifying your PNC Bank routing number, where to find it, and how it fits into your financial life. So grab a coffee, sit back, and let’s dive in!

Read also:Dallas Project Dox The Ultimate Guide To Understanding The Controversy And Impact

Understanding the Basics: What is a PNC Bank Routing Number?

Let’s start with the basics. A PNC Bank routing number is essentially a nine-digit code that identifies your bank and its location. Think of it as your bank’s address in the world of electronic transactions. Whenever you initiate a transfer, the routing number ensures that your money reaches the right place without any mix-ups.

Here’s why it’s so important:

- It helps financial institutions process payments accurately.

- It ensures that funds are routed to the correct branch or account.

- It’s required for tasks like direct deposits, bill payments, and wire transfers.

For PNC Bank, the routing number is specific to the state where your account was opened. That’s why it’s crucial to double-check the correct number for your location before making any transactions.

Why Do You Need a PNC Bank Routing Number?

Now that we know what a routing number is, let’s talk about why you need it. Whether you’re a small business owner or an individual managing personal finances, having your PNC Bank routing number handy is essential for several reasons:

- Direct Deposits: If you want your paycheck or government benefits deposited directly into your account, you’ll need to provide your employer or agency with your routing number.

- Bill Payments: Setting up automatic payments for utilities, loans, or subscriptions often requires your routing number.

- Wire Transfers: Sending or receiving large sums of money internationally or domestically involves using your routing number.

- Check Writing: When you write a check, the routing number is printed at the bottom to help the recipient’s bank process it.

Without the right routing number, your transactions could get delayed or even rejected. So, it’s always a good idea to keep it close by.

How to Find Your PNC Bank Routing Number

Finding your PNC Bank routing number is easier than you think. Depending on what you’re trying to do, there are several ways to locate it:

Read also:Paula Abdul Height The Real Story Behind The Stars Stature

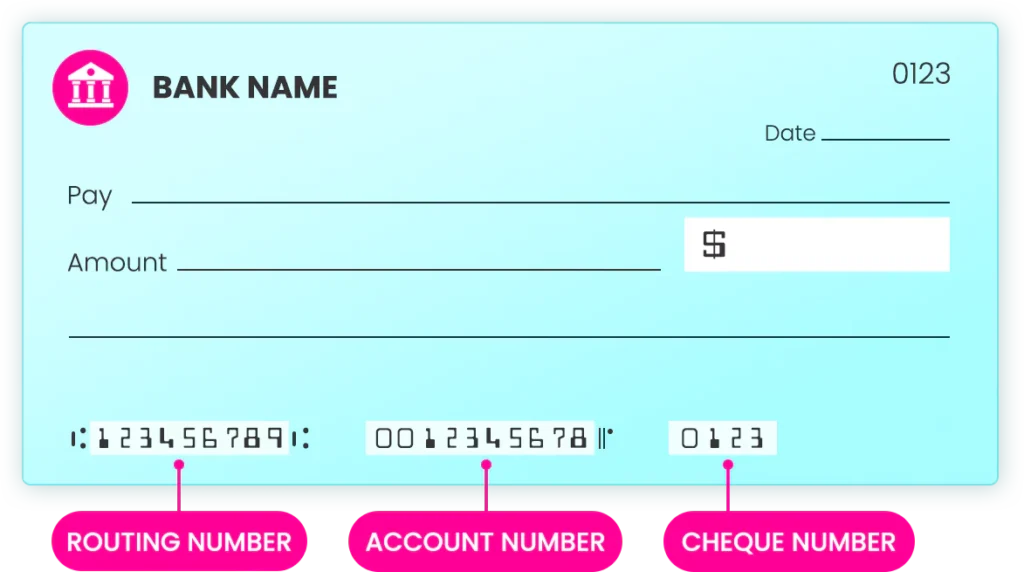

1. Check the Bottom of Your Checks

If you have physical checks from PNC Bank, look at the bottom. The routing number is the first set of nine digits on the left side. It’s usually followed by your account number and the check number.

2. Log in to Your Online Banking

Your PNC Bank online account is another great place to find your routing number. Simply log in, navigate to the account details section, and you should see it listed there. Some users prefer this method because it’s quick and convenient.

3. Call PNC Bank Customer Service

Not a fan of hunting for numbers yourself? No problem! You can always call PNC Bank’s customer service hotline. Their friendly agents will be happy to provide your routing number over the phone. Just make sure you have your account information ready for verification.

State-Specific Routing Numbers for PNC Bank

One thing to keep in mind is that PNC Bank has different routing numbers depending on the state where your account was opened. Here’s a quick breakdown:

- Pennsylvania: 031000051

- Ohio: 043203639

- West Virginia: 051404906

- Illinois: 071927896

- Florida: 063102088

These numbers are just examples, so always confirm the correct one for your state. If you’re unsure, you can always refer back to your checks or contact PNC Bank directly.

What Happens if You Use the Wrong Routing Number?

Using the wrong routing number can cause major headaches. Your transaction might get delayed, returned, or even rejected. In some cases, you could be charged fees for the mistake. That’s why accuracy is key when dealing with routing numbers.

Here’s what you can do if you accidentally use the wrong number:

- Contact PNC Bank immediately to report the error.

- Provide them with the transaction details so they can investigate.

- Follow up regularly until the issue is resolved.

While it might take some time to fix, most banks are pretty efficient at handling these situations. Just stay calm and work closely with PNC Bank’s support team.

Is Your Routing Number the Same as Your Account Number?

Nope, your routing number and account number are two completely different things. Your routing number identifies your bank and its location, while your account number is unique to your specific account. Think of it like this:

- Routing Number: The bank’s address.

- Account Number: Your personal mailbox at that address.

Both numbers are essential for any transaction involving your PNC Bank account. So, always double-check that you’re entering the right ones to avoid any mix-ups.

Can You Use the Same Routing Number for All Transactions?

Not exactly. While your PNC Bank routing number stays the same for most domestic transactions, international wire transfers require a different number. This is known as the SWIFT code, which is used specifically for cross-border transactions.

Here’s a quick rundown:

- Domestic Transactions: Use your regular PNC Bank routing number.

- International Transactions: Use PNC Bank’s SWIFT code, which is PNCCUS33.

Always confirm the correct code based on the type of transaction you’re making to ensure everything goes smoothly.

Security Tips for Protecting Your Routing Number

Your routing number might seem harmless, but it’s still important to keep it safe. Here are a few tips to protect it:

- Don’t Share It Casually: Only provide your routing number when absolutely necessary, like for legitimate financial transactions.

- Shred Old Checks: If you have old checks lying around, make sure to shred them before throwing them away.

- Monitor Your Account: Keep an eye on your PNC Bank account for any suspicious activity. Report anything unusual to the bank right away.

By taking these precautions, you can help safeguard your financial information and prevent potential fraud.

How PNC Bank Routing Numbers Fit Into Modern Banking

With the rise of digital banking, routing numbers have become even more crucial. They’re the backbone of electronic transactions, ensuring that money flows seamlessly between accounts. PNC Bank, like many other financial institutions, relies heavily on routing numbers to maintain efficient operations.

Here’s how routing numbers play a role in modern banking:

- They enable faster and more secure transactions.

- They reduce the risk of errors in processing payments.

- They help banks comply with regulatory requirements.

As technology continues to evolve, routing numbers will likely remain an essential part of the banking system for years to come.

Common Questions About PNC Bank Routing Numbers

1. Can I Find My Routing Number on the Mobile App?

Absolutely! Just log in to the PNC Bank mobile app, go to your account details, and you should see your routing number listed there. It’s a super convenient way to access it anytime, anywhere.

2. Do All PNC Bank Accounts Have the Same Routing Number?

Nope. As we mentioned earlier, PNC Bank routing numbers vary by state. So, the number you use depends on where your account was opened.

3. What Should I Do if My Routing Number Changes?

If PNC Bank updates its routing numbers, they’ll notify you well in advance. In the meantime, you don’t need to worry about changing anything unless you’re setting up a new transaction.

Conclusion: Mastering Your PNC Bank Routing Number

And there you have it—everything you need to know about PNC Bank routing numbers. From understanding what they are to finding and using them correctly, you’re now equipped with the knowledge to navigate your financial transactions with confidence.

Remember, accuracy is key when it comes to routing numbers. Always double-check the correct number for your location and keep it safe to protect your financial information. If you ever have questions or run into issues, PNC Bank’s customer service team is always ready to assist you.

So, what are you waiting for? Put your newfound expertise to use and take control of your finances like a pro. Don’t forget to share this article with friends and family who might find it helpful. Together, let’s make banking easier and more understandable for everyone!

Table of Contents

- Understanding the Basics: What is a PNC Bank Routing Number?

- Why Do You Need a PNC Bank Routing Number?

- How to Find Your PNC Bank Routing Number

- State-Specific Routing Numbers for PNC Bank

- What Happens if You Use the Wrong Routing Number?

- Is Your Routing Number the Same as Your Account Number?

- Can You Use the Same Routing Number for All Transactions?

- Security Tips for Protecting Your Routing Number

- How PNC Bank Routing Numbers Fit Into Modern Banking

- Common Questions About PNC Bank Routing Numbers

![Your PNC Bank Routing Number [Revealed!]](https://theblissfulbudget.com/wp-content/uploads/2022/09/pnc-bank-routing-number.jpg)