Gerber College Plan Vs 529: Which One Is The Smart Choice For Your Kid's Education?

Let’s face it, parents—college ain’t getting cheaper anytime soon. If you’re trying to figure out how to save for your kid’s future without breaking the bank, you’ve probably stumbled upon two popular options: the Gerber College Plan and the 529 plan. But here’s the million-dollar question: which one’s the better fit for you?

Imagine this: you’re sitting at your kitchen table, scrolling through articles about college savings plans, and suddenly you’re hit with a wave of confusion. Don’t worry, it happens to the best of us. The Gerber College Plan and 529 plans are both designed to help you save for your child’s education, but they’re not exactly the same. So, buckle up because we’re about to break it all down for you in a way that’s easy to digest.

Now, before we dive deep into the nitty-gritty details, let’s just say this: both plans have their pros and cons. It’s not a one-size-fits-all situation, and what works for one family might not work for another. Stick with me, and by the end of this article, you’ll have a clearer picture of which option aligns better with your financial goals.

Read also:David Muir New Wife The Love Story Thats Capturing Hearts

What is the Gerber College Plan?

The Gerber College Plan is like a little safety net wrapped up in a savings package. It’s a prepaid college savings plan that locks in today’s tuition rates for your child’s future education. Think of it as buying tomorrow’s groceries at today’s prices. Pretty neat, right?

Here’s the deal: when you enroll in the Gerber College Plan, you’re essentially purchasing units of tuition at participating colleges and universities. The value of these units increases over time, which means you won’t have to worry about skyrocketing tuition costs down the road. Plus, it’s super simple to set up and manage—no investment expertise required.

But hold up, there’s more! The Gerber College Plan also offers some flexibility. If your kid decides not to go to a participating school, you can transfer the funds to another family member or even get a refund. It’s like having a backup plan for your backup plan.

What is a 529 Plan?

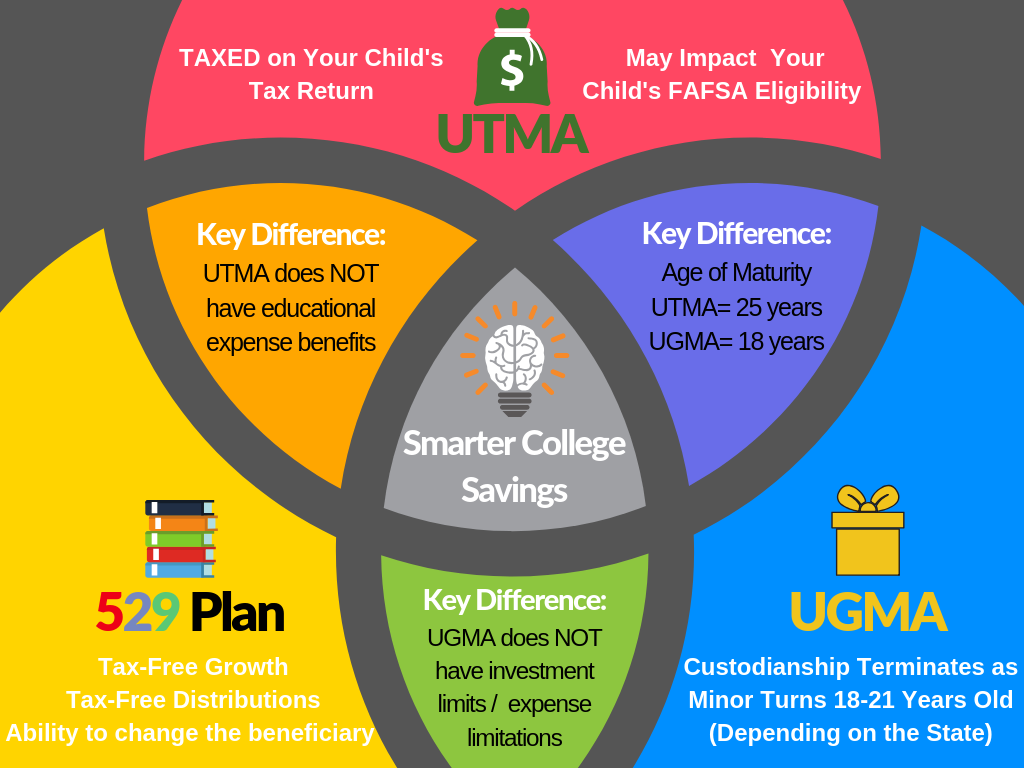

On the other hand, we’ve got the 529 plan, which is like the Swiss Army knife of college savings. It’s a tax-advantaged investment account specifically designed to help families save for higher education expenses. From tuition to books and even room and board, a 529 plan can cover a wide range of costs.

The beauty of a 529 plan is that your contributions grow tax-free, and withdrawals are also tax-free as long as they’re used for qualified education expenses. This makes it a pretty sweet deal for anyone looking to maximize their savings potential. Plus, there’s no limit on how much you can contribute, although there are gift tax implications to consider if you go over a certain amount.

But wait, there’s another cool feature: most states offer their own version of a 529 plan, and some even provide state tax benefits for contributions. So, if you’re lucky enough to live in one of those states, you could be saving even more money in the long run.

Read also:Whats An Otter In The Gay World A Comprehensive Guide To Understanding Otters And Their Role In Lgbtq Culture

Gerber College Plan vs 529: Key Differences

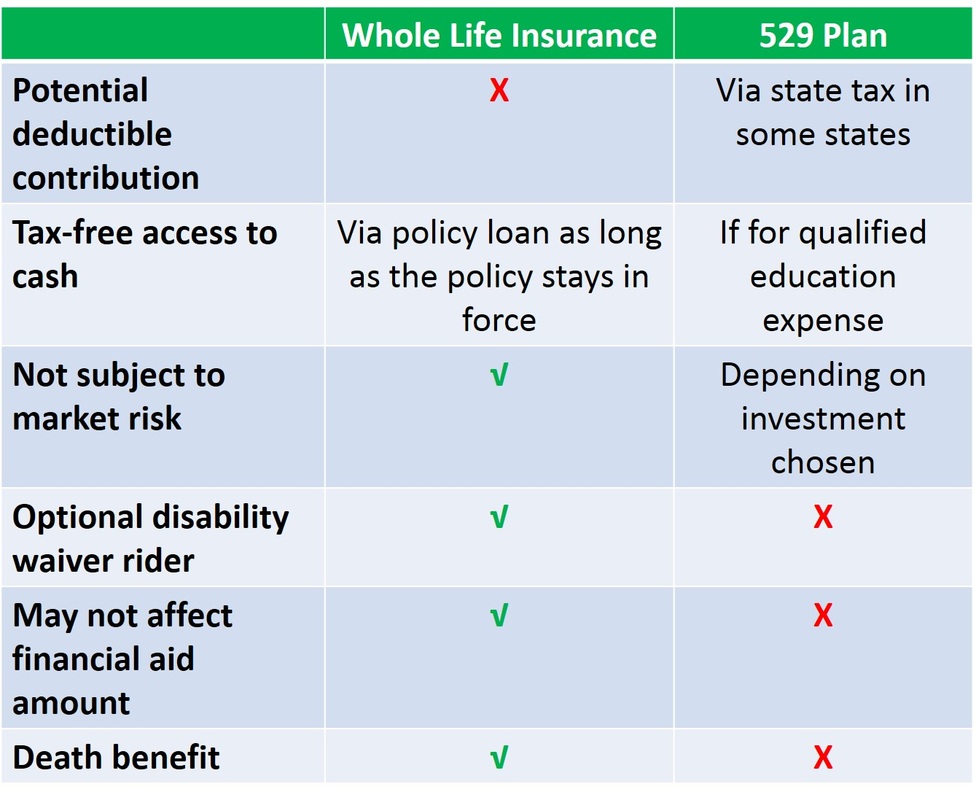

Now that we’ve got the basics out of the way, let’s talk about the main differences between the Gerber College Plan and the 529 plan. Here’s a quick rundown:

- Investment Flexibility: The Gerber College Plan is more rigid, as it’s tied to specific schools, while a 529 plan offers more flexibility with a broader range of investment options.

- Tax Benefits: Both plans offer tax advantages, but a 529 plan generally provides more robust benefits, especially if you’re in a state that offers tax deductions for contributions.

- Cost Coverage: The Gerber College Plan primarily focuses on tuition, whereas a 529 plan can cover a wider range of education-related expenses.

- Participating Schools: The Gerber College Plan is limited to participating colleges and universities, while a 529 plan can be used at virtually any accredited institution.

Advantages of the Gerber College Plan

Let’s zoom in on the good stuff about the Gerber College Plan. First off, it’s super simple to understand and manage. No complicated investment strategies or financial jargon to decipher. Just set it up, and you’re good to go.

Another big plus is the guaranteed tuition coverage. With tuition costs rising faster than you can say “student loan,” locking in today’s rates can save you a ton of money in the long run. Plus, the plan is backed by Gerber Life Insurance Company, which gives you that extra peace of mind.

And let’s not forget about the flexibility. If your kid decides to take a different path, you’ve got options. You can transfer the funds to another family member or even get a refund. It’s like having a financial safety net for your family.

Limitations of the Gerber College Plan

Of course, no plan is perfect, and the Gerber College Plan has its fair share of limitations. For starters, it’s limited to participating schools, which might not include your child’s dream college. And if they decide to attend a non-participating school, you might not get the full value of your investment.

Also, the Gerber College Plan primarily focuses on tuition, so you’ll still need to figure out how to cover other expenses like room and board, books, and fees. And let’s be real, those costs can add up quickly.

Advantages of the 529 Plan

Now, let’s talk about why the 529 plan is such a popular choice among parents. First and foremost, it offers incredible tax advantages. Your contributions grow tax-free, and withdrawals are also tax-free as long as they’re used for qualified education expenses. That’s a win-win situation for anyone looking to stretch their savings further.

Another huge advantage is the flexibility. A 529 plan can be used at virtually any accredited institution, whether it’s a public university, private college, or even a vocational school. And if your kid decides not to go to college, you can always change the beneficiary to another family member.

Plus, most states offer their own version of a 529 plan, and some even provide state tax benefits for contributions. If you’re lucky enough to live in one of those states, you could be saving even more money in the long run.

Limitations of the 529 Plan

Despite its many advantages, the 529 plan does have its downsides. For one, it’s an investment account, which means there’s always some level of risk involved. Unlike the Gerber College Plan, there’s no guarantee that your contributions will keep pace with rising tuition costs.

And if you withdraw funds for non-qualified expenses, you’ll have to pay taxes and a 10% penalty on the earnings portion. So, it’s important to plan carefully and make sure you’re using the funds for education-related purposes.

Which Plan is Right for You?

So, how do you decide between the Gerber College Plan and the 529 plan? It all comes down to your unique situation and financial goals. If you’re looking for a simple, straightforward option that guarantees tuition coverage, the Gerber College Plan might be the way to go.

But if you want more flexibility, tax advantages, and the ability to cover a wider range of education-related expenses, the 529 plan could be the better choice. It’s all about weighing the pros and cons and figuring out what works best for your family.

Factors to Consider

Here are a few key factors to consider when making your decision:

- School Preferences: Do you have a specific school in mind for your child, or are you open to options?

- Financial Goals: Are you looking for guaranteed tuition coverage, or are you willing to take on some investment risk for potentially higher returns?

- Tax Benefits: Does your state offer tax incentives for 529 plan contributions?

- Flexibility: How important is it to have the ability to use the funds for a variety of education-related expenses?

How to Get Started

Ready to take the plunge? Here’s how you can get started with either the Gerber College Plan or a 529 plan:

For the Gerber College Plan, you can sign up directly through Gerber Life Insurance Company. It’s a straightforward process, and you can set up automatic contributions to make saving even easier.

For a 529 plan, you’ll need to choose a plan offered by your state or another state that you’re interested in. Each plan has its own rules and features, so it’s important to do your research and pick the one that aligns with your goals. Once you’ve selected a plan, you can open an account online and start contributing.

Conclusion

Alright, folks, that’s the scoop on the Gerber College Plan vs 529. Both plans have their strengths and weaknesses, and the right choice depends on your unique situation and financial goals. If you’re looking for simplicity and guaranteed tuition coverage, the Gerber College Plan might be the way to go. But if you want more flexibility, tax advantages, and the ability to cover a wider range of expenses, the 529 plan could be the better fit.

So, what’s next? Take some time to weigh your options, do your research, and talk to a financial advisor if you need help making a decision. And don’t forget to share this article with other parents who might be in the same boat. After all, saving for college is a team effort, and the more knowledge we share, the better prepared we’ll be for the future.

References

For more information on the Gerber College Plan and 529 plans, check out these trusted sources:

Table of Contents

- Gerber College Plan vs 529: Which One is the Smart Choice for Your Kid's Education?

- What is the Gerber College Plan?

- What is a 529 Plan?

- Gerber College Plan vs 529: Key Differences

- Advantages of the Gerber College Plan

- Limitations of the Gerber College Plan

- Advantages of the 529 Plan

- Limitations of the 529 Plan

- Which Plan is Right for You?

- How to Get Started

- Conclusion