Routing Number For Pnc Bank Nc: A Simple Guide To Unlock The Mystery

Are you scratching your head trying to figure out what the heck a routing number is, especially when it comes to PNC Bank in North Carolina? Well, you’re not alone. Many folks find themselves stuck in this exact spot when they need to transfer funds, set up direct deposits, or pay bills online. So, let’s break it down and make it super clear for you.

You might be wondering, why does this matter? Well, the routing number for PNC Bank NC is essentially like the bank’s address. It tells the financial system where your money needs to go. Without it, your transactions could end up lost in cyberspace—or worse, in someone else’s account! Don’t worry, we’ll cover everything you need to know so you can avoid those headaches.

In this guide, we’ll dive deep into the world of routing numbers, focusing on PNC Bank in North Carolina. By the end of this article, you’ll not only know what your routing number is but also understand how it works and why it’s crucial for your banking needs. Let’s get started!

Read also:Telegram Wasmo The Ultimate Guide To Trending Chat Culture

What Exactly is a Routing Number?

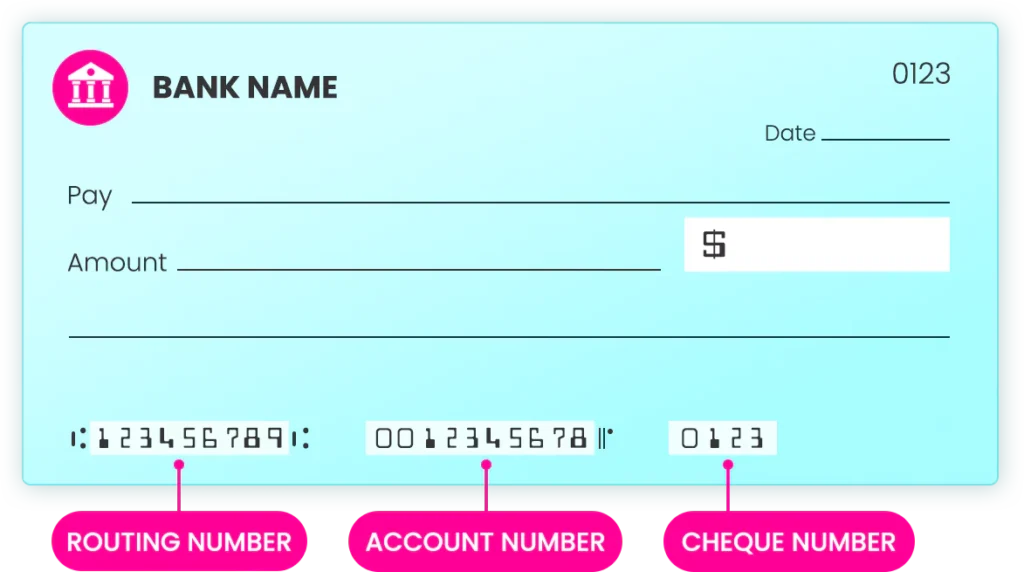

Let’s start with the basics. A routing number is a nine-digit code that identifies your bank or financial institution. Think of it as a zip code for banks. It’s used to route money to the right place when you’re making transactions like direct deposits, bill payments, or wire transfers. For PNC Bank in North Carolina, this number is super important if you want your money to end up exactly where it should be.

Now, here’s the kicker: not all banks use the same routing number across the country. Some banks, like PNC, have different routing numbers depending on the state where you opened your account. So, if you’re in North Carolina, you’ll need to know the specific routing number assigned to PNC Bank NC accounts.

Why Do You Need a Routing Number?

You might be thinking, “Why does this even matter?” Well, here’s the deal: whenever you need to move money in or out of your account, the routing number acts as a guide. Without it, the financial system wouldn’t know which bank to send your funds to. Imagine sending a letter without an address—it’s not gonna work out well!

Here are a few common scenarios where you’ll need your routing number:

- Setting up direct deposit for your paycheck

- Transferring money between accounts

- Paying bills online

- Initiating wire transfers

Routing Number for PNC Bank NC: The Lowdown

Alright, let’s get to the meat of the matter. The routing number for PNC Bank NC accounts is 053100945. That’s the magic number you’ll need for all your banking activities in North Carolina. Easy, right? But hold up—there’s more to it than just memorizing those digits.

How to Find Your Routing Number

What if you’re not sure which routing number applies to your account? Don’t panic! There are a few simple ways to find it:

Read also:Unveiling The Cast Of Jason X A Deep Dive Into Horrorrsquos Scifi Evolution

- Check your checks: The routing number is usually printed on the bottom left corner of your checks.

- Log in to your online banking account: PNC makes it super easy to find your routing number by logging into your account and navigating to the account details section.

- Call customer service: If you’re still unsure, give PNC a ring. Their customer service team can help you out in no time.

Understanding the Different Types of Routing Numbers

Did you know that there are different types of routing numbers? Yep, it’s true! Depending on the transaction you’re making, you might need a specific type of routing number. For example, wire transfers often require a different routing number than regular ACH transactions. Let’s break it down:

ACH Routing Number

An ACH routing number is used for electronic transfers, such as direct deposits and bill payments. For PNC Bank NC accounts, the ACH routing number is the same as the one we mentioned earlier: 053100945. Easy peasy!

Wire Transfer Routing Number

Now, if you’re doing a wire transfer, things get a little different. PNC uses a separate routing number for domestic wire transfers, which is 043000096. For international wire transfers, you’ll need to use the SWIFT code PNCBUS33XXX. See? Not so complicated once you know the drill!

Common Mistakes to Avoid

When it comes to routing numbers, even the smallest mistake can cause big problems. Here are a few common errors to watch out for:

- Using the wrong routing number for the type of transaction

- Transposing digits (mixing up the numbers)

- Not double-checking the routing number before initiating a transaction

Trust me, you don’t want to mess this up. If you send your money to the wrong bank, it could take days—or even weeks—to sort it out. So, take a deep breath, double-check, and triple-check before you hit that send button.

Tips for Keeping Your Routing Number Safe

Your routing number is sensitive information, so it’s important to keep it secure. Here are a few tips to protect yourself:

- Don’t share your routing number unless it’s absolutely necessary

- Be cautious when entering your routing number online—make sure the website is secure

- Shred any documents that contain your routing number before throwing them away

Remember, your financial information is like gold. Keep it safe, and you’ll avoid a whole lot of hassle down the road.

How to Use Your Routing Number Effectively

Now that you know what a routing number is and how to find it, let’s talk about how to use it effectively. Here are a few scenarios where you’ll need to put your newfound knowledge to the test:

Setting Up Direct Deposit

Direct deposit is a game-changer. It’s fast, secure, and convenient. To set it up, you’ll need to provide your employer with your routing number and account number. Once they have that info, your paycheck will be deposited directly into your account—no more waiting in line at the bank!

Transferring Money Between Accounts

Need to move money from one account to another? Whether it’s paying off a loan or saving for a rainy day, you’ll need your routing number to make it happen. Just log in to your online banking account, enter the recipient’s details, and voilà—your money is on its way!

FAQs About Routing Numbers for PNC Bank NC

Still have questions? Don’t worry, we’ve got you covered. Here are some frequently asked questions about routing numbers for PNC Bank NC:

Can I Use the Same Routing Number for All Transactions?

Not necessarily. While the ACH routing number is the same for most transactions, wire transfers require a different routing number. Always double-check to make sure you’re using the right one.

What Happens If I Use the Wrong Routing Number?

If you use the wrong routing number, your transaction might be delayed or even rejected. In some cases, your money could end up in the wrong account, which can be a major headache to fix. So, take your time and get it right the first time!

Conclusion

There you have it—a comprehensive guide to routing numbers for PNC Bank NC. By now, you should feel confident in your ability to find, use, and protect your routing number. Remember, this little nine-digit code is the key to unlocking smooth and secure banking transactions.

So, what’s next? If you found this article helpful, why not share it with a friend? Or, if you have any questions or comments, drop them below. We’d love to hear from you! And don’t forget to check out our other articles for more tips and tricks on all things finance.

Table of Contents

- What Exactly is a Routing Number?

- Why Do You Need a Routing Number?

- Routing Number for PNC Bank NC: The Lowdown

- How to Find Your Routing Number

- Understanding the Different Types of Routing Numbers

- Common Mistakes to Avoid

- Tips for Keeping Your Routing Number Safe

- How to Use Your Routing Number Effectively

- FAQs About Routing Numbers for PNC Bank NC

- Conclusion